Over the last few years there has been a clear trend with digitally native, DTC brands taking advantage of Out of Home’s ability to drive eCommerce. It is a powerful and practical way to build large scale brand awareness, and almost serve as a surrogate physical presence in the market.

Now, with the economic fallout from the COVID pandemic causing major retailers to close many, if not all, of their retail locations those advertisers would do well to take a lesson from the DTC brand playbook and turn to Out of Home as more important piece of their media mix.

Consumer behavior has changed dramatically because of COVID:

We are at a point in this new social economic environment that we can start to take some stock of what has happened, where we are, and possibly what the future may hold. The first and most obvious is the change in consumer behavior. Shelter in place and other lockdowns have forced consumers to find new ways to support both their basic needs, as well as their entertainment and other discretionary spending. The growth in online shopping has been nothing short of a paradigm shift.

Vivek Pandya, Adobe’s Digital Insights Manager had this to say in a recent Forbes article: “According to our data, it would’ve taken between 4 and 6 years to get to the levels that we saw in May if the growth continued at the same levels it was at for the past few years,”.

He also noted that “ecommerce sales are still up 55% year over year for the first seven months of the year, resulting in $434.5 billion in online spending… And Adobe expects 2020 online sales to surpass the total online sales in 2019 by Oct. 5, 2020, well before holidays season sales begin to ramp up”.

COVID is forcing store closures:

While online sales are skyrocketing, the big picture is still bleak for many retailers as many have already declared bankruptcy while others are holding on by a thread. Shelter in place orders and statewide lockdowns have taken such a chunk out of retail that for many, maintaining physical stores just isn’t an option any more. According to the Wall Street Journal “U.S. retailers are on track to close as many as 25,000 stores this year as the coronavirus pandemic upends shopping habits. That is more than double the 9,832 stores that closed in 2019”

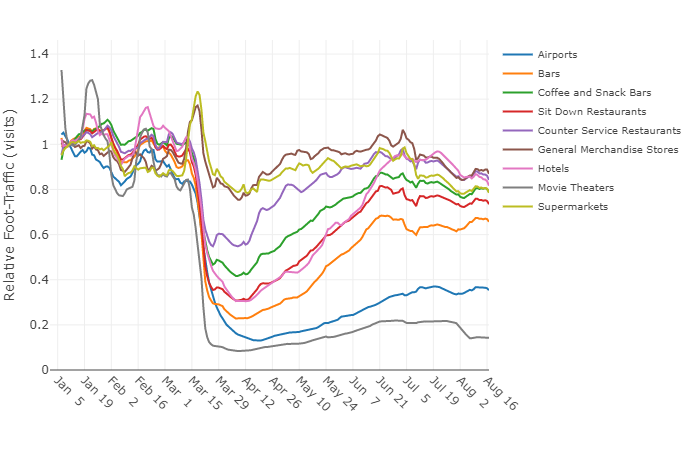

Analysis from location data expert Safegraph shows just how hard and fast traffic hit the floor. And, while retail foot traffic is trending upward and, for some sectors and geographic areas, approaching normal the net result for many retailers has just been too much to sustain.

The Digital Trap for Advertisers:

The tendency over the last few years has been to focus heavily on performance marketing. Digital media, with its inherent measurability, has enabled advertisers to place significant emphasis on these channels. As brands are forced to close stores, they will look to online to pick up the revenue slack and there will be an inherent tendency to continue the emphasis on digital media, and measurability and short-term goals. But this loses sight of important brand building efforts. In a recent interview Jerry Daykin, media director at healthcare company GSK shared his view:

“I always encourage marketers to also take a step back to what’s sometimes seen as slightly more old-fashioned forms of measurement: brand lift studies and econometrics and slightly slower-moving pieces that ultimately will really help you understand the performance of your media,”

As brands shift from a strong physical, in-market presence to all or mostly online it will be even more important that they don’t neglect the imperative of brand awareness and trust. And this is where Out of Homes ability to drive eCommerce can be a valuable asset.

OOH can serve as a surrogate/replacement for your physical locations

We’ve already discussed the importance of maintaining your advertising presence through difficult economic times. As brands are closing stores it’s important for them to maintain a physical presence in those communities – even once their brick and mortar locations are gone. Remaining visible and front of mind is key to filling the top of the sales funnel. Where stores once functioned as a de facto piece of media – with signage creating some brand awareness in the market – the loss of those stores can remove not just the awareness, but erode customer confidence in the reliability of the brand as they pull up the tent stakes.

As brands remove physical stores it will be critical to maintain existing customers, particularly as they will be asking those customers to move to a new shopping experience with them. Maintaining that trust is critical as “Some 8 in 10 US consumers (82%) and three-quarters (75%) of global respondents say they will continue to buy a brand they trust, even if another brand suddenly becomes hot and trendy.”

A recent study showed that Out of Home media is a powerful tool for maintaining brand trust. “Brands that dedicate 15% or more of their media budgets to out-of-home (OOH) advertising had a 24% increase in brand trust and 106% increase in perception of brand quality, according to a new study by Rapport, the OOH division of IPG Mediabrands, reported on by The Drum. OOH investments also boosted customer loyalty by 275%…”

Out of Home excels at driving eCommerce activity.

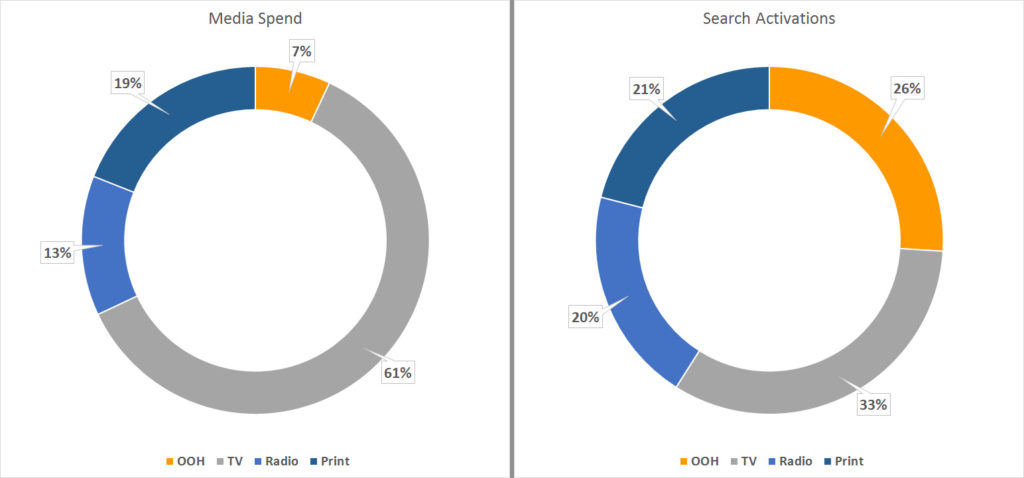

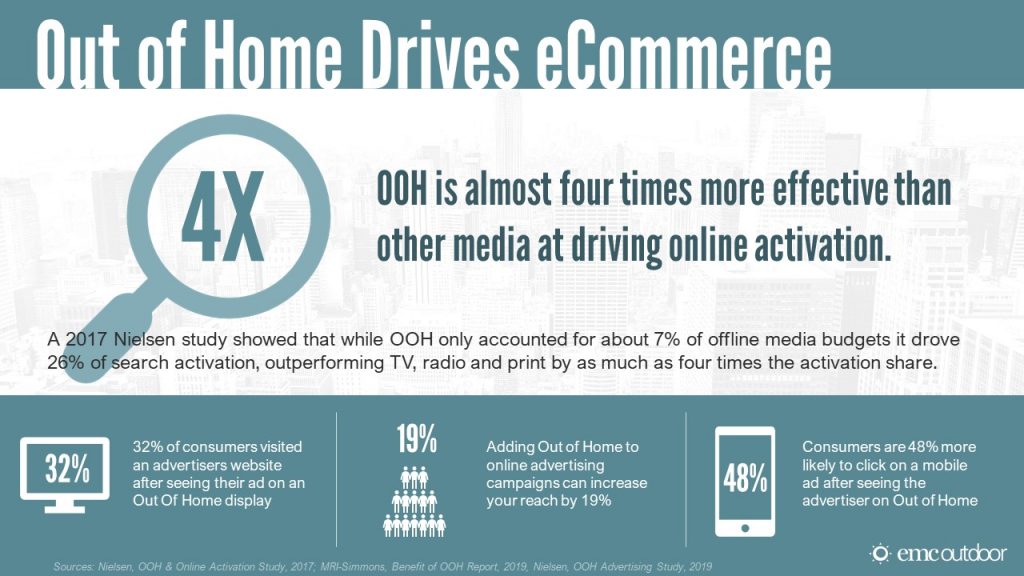

As retailers look to build their online business to take up the slack of their closed brick and mortar stores driving online traffic will be critical. While it might not seem obvious Out of Home drives eCommerce and outperforms almost all other media when it comes to driving online activation. According to Nielsen’s study from 2017 Out of Home indexes at almost four times the expected rate for driving online activity.

While OOH media generally makes up around 7% of media budgets, it generates 26% activation share for search. Activity rates on social media are even higher.

Additional research from Nielsen reinforces this. Data shows that Out of Home is effective in driving a variety of online activities. Consumers actions taken on their smartphones after viewing an OOH ad include:

- 42% have searched for the brand online

- 32% have visited the company’s website

- 33% have accessed a coupon or discount code

- 21% have downloaded or used an app in the ad

With this kind of ability to drive consumers actions online, brands should keep Out of Home media front and center in their media plans – particularly when trying to compensate for the closure of physical locations.

OOH is an easy way to increase frequency, and pave the path to purchase.

With all the recent advancements in OOH planning data – like the new Geopath Insights – it has become feasible to conduct highly targeted, hyperlocal campaigns that reach your core audience efficiently and effectively. One benefit this brings is the ability to increase the frequency of your messaging to your audience while minimizing any wasted impressions.

If we look at this in the context of the Rule of 7 this becomes a valuable asset. A well targeted OOH plan can help maximize frequency by intersecting with your customers in their daily and weekly routines – traveling to work, the grocery store, recreation. With the new levels of enhanced targeting we now know where those consumers travel with a much higher degree of accuracy. That means that their daily path can be aligned with their path to purchase using Out of Home as a key touchpoint to help build up the critical mass of messaging.

Where do retail and Out of Home go from here?

As the economic fallout from COVID continues to reshape the retail and online landscape businesses that have long leaned on physical retail as their main revenue source are having to rethink how they can continue to not just stay in business, but find new ways to thrive. Their online presence will be a critical piece of that model taking the place of their brick and mortar stores. And just like their stores, getting people there will be one of the most important pieces of their marketing plan. So, just as it has worked for many years to drive foot traffic to retail locations, Out of Home drives eCommerce and should be relied on by retailers to deliver online traffic.

![Out of Home and the Casual Consumer [Infographic]](https://www.emcoutdoor.com/blog/wp-content/uploads/2018/05/HEADER-100.jpg)